How Accounting Companies can Save You Time, Stress, and Money.

Wiki Article

Some Known Details About Accounting Service

Table of ContentsUnknown Facts About Accounting CompanyAccounting Services for DummiesSome Known Facts About Accounting Services.How Accounting Company can Save You Time, Stress, and Money.Not known Facts About Accounting Companies

The accountants are specializing in a particular field of bookkeeping as well as offer solutions in the location of their expertise to assist grow different services. Bookkeeping history dates back to old worlds

in Mesopotamia, Egypt, and Babylon. Luca Pacioli is considered "The Dad of Audit and also Accounting "due to his contributions to the development of audit as a career.Most firms will certainly have annual audits for one factor or another. Essentially, expense audit thinks about all of the expenses connected to generating an item.

Analysts, supervisors, company owners, and accountants use this info to identify what their items need to cost. In cost accountancy, cash is cast as an economic element in production, whereas in monetary accountancy, cash is thought about to be an action of a company's financial efficiency. Its criteria are based on double-entry audit, a method in which every bookkeeping transaction is entered gone into both a debit and and also credit report two 2 different ledger journal that will roll up into the balance equilibrium and and also revenueDeclaration

Accounting Company Fundamentals Explained

Tax obligation accounts might additionally lean know state or county tax obligations as outlined by the territory in which the service conducts organization. Foreign firms need to abide by tax assistance in the nations in which it have to submit a return. These steps are frequently described as the bookkeeping cycle, the process of taking raw purchase information, entering it into an accounting system, and running appropriate and also accurate economic records. The steps of the bookkeeping cycle are: Accumulate transaction info such as invoices, financial institution declarations, receipts, payment demands, uncashed checks, charge card statements, or various other mediums that might have company deals.Prepare an unadjustedtrial balance to guarantee all debits as well as debts equilibrium and also material general ledger accounts look appropriate. Post readjusting journal entries at the end of the period to reflect any changes to be made to the test balance run in Action 3. Prepare the adjusted trial balance to make sure these monetary equilibriums are materially proper and also affordable. Financial accounts have 2 different sets of regulations they can select to adhere to. The very first, the amassing basis approach of accounting, has actually been talked about over. These guidelines are laid out by GAAP as well as IFRS, are.

required by public firms, as well as are primarily utilized by bigger business. The 2nd set of guidelines adhere to the money basis method of audit. As a result of the streamlined fashion of bookkeeping, the cash technique is typically made use of by small companies or entities that are not called for to use the amassing technique of audit. Think of a company purchases $1,000 of stock on.

credit rating. Settlement schedules for the supply in one month (accounting companies). Under the amassing approach of audit, a journal entrance is taped when the order is put. When thirty day has actually passed and also the inventory is actually spent for, the firm publishes a 2nd journal access: a debit to accounts payable(responsibility)for$1,000 and also a credit to cash money (property) for$1,000. Under the cash money approach of audit, a journal access is only taped when cash money has been traded advice for inventory. The access is a debit to inventory (asset) for $1,000 and a credit score to cash money (property) for $1,000. The difference between these 2 accounting methods is the therapy of accruals. Naturally, under the amassing technique of bookkeeping, amassings are required. Under the cash money method, amassings are not required and also not recorded. External capitalists desire confidence that they understand what they are spending in. Before private funding, financiers will normally require monetary declarations(usually audited )to assess the total health and wellness of a firm.

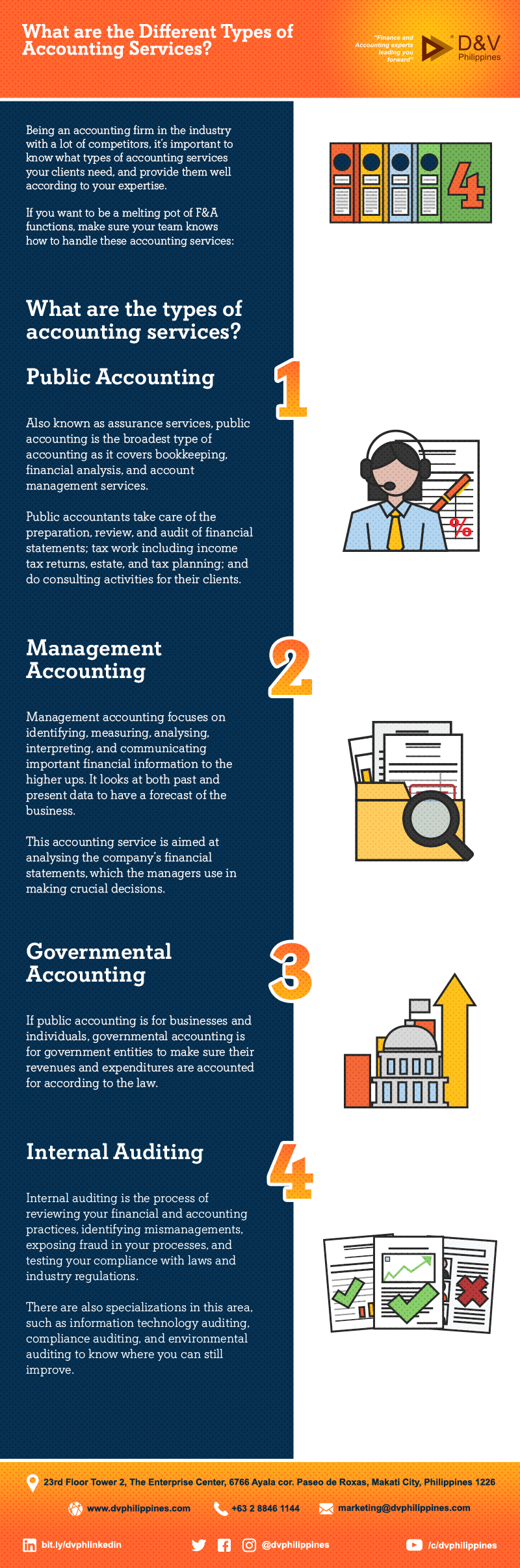

When individuals think about the accountancy area, generally tax obligations come to mind. And while a great deal of CPA's and accountants do work in tax preparation or with tax returns, did you recognize there are numerous various other kinds of accounting firms in the industry? Audit entails a whole lot even more than simply taxes. Audit Firms Audit companies handle examinations into a business's financial resources or other area to offer objective and also third-party findings. 4. Outsourced Accounting Firms Instead of having internal bookkeeping divisions, local business can choose to agreement with an outsourced accountancy firm, which provides full accounting solutions for their clients and also handle

funds for business. There are 8 branches of bookkeeping that permit services to track as well as gauge their business's finances. Each branch has its own specialized usage that discloses different insights into a business's monetary condition. Recognizing the different branches of accounting is essential for service proprietors, as it can have a significant effect on the.

Some Known Facts About Accounting Company.

The cash money accounting method is utilized, but accrual bookkeeping accounts for all purchases that make up a company's operating activities. Payables accrue up until the company settles the underlying debt. The financial statements made use of in monetary bookkeeping supply useful info to creditors and also financiers concerning a firm's efficiency.

How Accounting Services can Save You Time, Stress, and Money.

Utilizing standard expense bookkeeping helps substantially in locating differences and alsoinvestigating the examining behind factors. Activity-based expense bookkeeping can help company proprietors and also managers comprehend expenses and also cost chauffeurs, which can then permit monitoring to decrease or eliminate components or activities that are expensive as well as don't give value to the organization. Whereas standard accountancy is developed to sustain mass manufacturing, lean audit focuses on assisting managers enhance the general performance of their operation (online accounting services in Vancouver).

Lean accounting can help an organization uncover ways to get rid of waste, enhance high quality, speed production as well as boost productivity. Limited expense accountancy refers to the boost or reduce in the cost of creating one more unit or serving one even more consumer. This audit is typically done by an accountancy firm.

Report this wiki page